I am showing the article written by Robert Shiller, Nobel Prize laureate, because people become famous because they write about "possibilities".

If the event they discuss happens then they say ..."I told you so". If the event does not happen they can always say they were talking only about "possibilities" without giving a timeframe surrounding the "possibility".

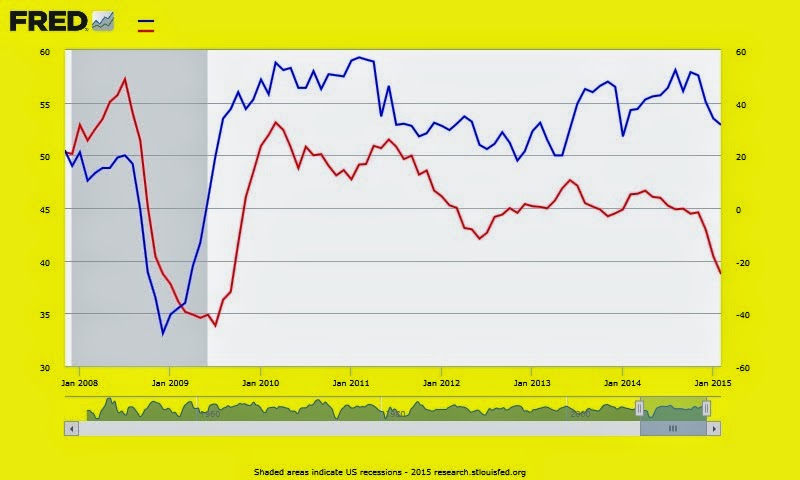

The issue for an investor is not about "possibilities". The investor needs to know what to do. For instance I believe our economy is weak.The outcome has been lower commodities and lower yields (higher bond prices)..The above chart shows the yields on 10-year Treasury bonds since 2013. Yields have been heading lower.since January 2014 (click on the chart to enlarge it).

Will they rise? Only if the economy strengthens and commodities rise (including lumber, copper, and oil). This will be the time to sell bonds. Not until then. Meanwhile bonds can still offer attractive capital gains.

And now, please read this excellent article about future "possibilities". It ha important strategic implications for all investors.

Authored by Robert Shiller, originally posted at Project Syndicate,

The prices of long-term government bonds have been running very high in recent years (that is, their yields have been very low). In the United States, the 30-year Treasury bond yield reached a record low (since the Federal Reserve series began in 1972) of 2.25% on January 30. The yield on the United Kingdom's 30-year government bond fell to 2.04% on the same day. The Japanese 20-year government bond yielded just 0.87% on January 20.

All of these yields have since moved slightly higher, but they remain exceptionally low. It seems puzzling – and unsustainable – that people would tie up their money for 20 or 30 years to earn little or nothing more than these central banks' 2% target rate for annual inflation.

So, with the bond market appearing ripe for a dramatic correction, many are wondering whether a crash could drag down markets for other long-term assets, such as housing and equities.

It is a question that I am repeatedly asked at seminars and conferences. After all,

participants in the housing and equity markets set prices with a view to prices in the bond market, so contagion from one long-term market to another seems like a real possibility.

I have been thinking about the bond market for a long time. In fact, the long-term bond market was the subject of my 1972 PhD dissertation and my first-ever academic publication the following year, co-authored with my academic adviser, Franco Modigliani. Our work with data for the years 1952-1971 showed that the long-term bond market back then was pretty easy to describe. Long-term interest rates on any given date could be explained quite well as a certain weighted average of the last 18 quarters of inflation and the last 18 quarters of short-term real interest rates. When either inflation or short-term real interest rates went up, long-term rates rose. When either fell, so did long-term rates.

We now have more than 40 years of additional data, so I took a look to see if our theory still predicts well. It turns out that our estimates then, if applied to subsequent data, predicted long-term rates extremely well for the 20 years after we published; but then, in the mid-1990s, our theory started to overpredict.

According to our model, long-term rates in the US should be even lower than they are now, because both inflation and short-term real interest rates are practically zero or negative. Even taking into account the impact of quantitative easing since 2008, long-term rates are higher than expected.

But the explanation that we developed so long ago still fits well enough to encourage the belief that we will not see a crash in the bond market unless central banks tighten monetary policy very sharply (by hiking short-term interest rates) or there is a major spike in inflation.

Bond-market crashes have actually been relatively rare and mild. In the US, the biggest one-year drop in the Global Financial Data extension of Moody's monthly total return index for 30-year corporate bonds (going back to 1857) was 12.5% in the 12 months ending in February 1980. Compare that to the stock market: According to the GFD monthly S&P 500 total return index, an annual loss of 67.8% occurred in the year ending in May 1932, during the Great Depression, and one-year losses have exceeded 12.5% in 23 separate episodes since 1900.

It is also worth noting what kind of event is needed to produce a 12.5% crash in the long-term bond market. The one-year drop in February 1980 came immediately after Paul Volcker took the helm of the Federal Reserve in 1979. A 1979 Gallup Poll had shown that 62% of Americans regarded inflation as the “most important problem facing the nation." Volcker took radical steps to deal with it, hiking short-term interest rates so high that he created a major recession. He also created enemies (and even faced death threats). People wondered whether he would get away with it politically, or be impeached.

Regarding the stock market and the housing market, there may well be a major downward correction someday. But it probably will have little to do with a bond-market crash. That was the case with the biggest US stock-market corrections of the last century (after 1907, 1929, 1973, 2000, and 2007) and the biggest US housing-market corrections of all time (after 1979, 1989, and 2006).

It is true that extraordinarily low long-term bond yields put us outside the range of historical experience. But so would a scenario in which a sudden bond-market crash drags down prices of stocks and housing. When an event has never occurred, it cannot be predicted with any semblance of confidence.

More details in The Peter Dag Portfolio on www.peterdag.com

George Dagnino, PhD

Editor

The Peter Dag Portfolio

Since 1977

Disclaimer. The content on this site is provided as general information only and should not be taken as investment advice nor is it a recommendation to buy or sell any financial instrument. Actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility.

STRATEGIC INVESTING FOR UNCERTAIN TIMES.

Learn how to manage your portfolio risk and sleep comfortably. Improve the certainty of returns by taking advantage of business cycle trends. Learn to use simple hedging strategies to minimize the volatility of your portfolio and protect it from downside losses.

You will receive your user id to access 2 FREE issues – and all the previous ones - of The Peter Dag Portfolio. Email your request to info@peterdag.com. New subscribers, please.

FOLLOW ME ALSO ON TWITTER @GEORGEDAGNINO FOR MY LATEST VIEWS.